iowa homestead tax credit application

Please check individual departments for contact information and office hours. If you are not currently receiving this credit and think you might be eligible please call the Pocahontas County Assessor at 712-335-5016.

Mortgage Credit Certificates Texas State Affordable Housing Corporation Tsahc

Property Tax Motor Vehicle and Drivers License.

. Disabled Veterans Homestead Tax Credit Application. Box 388 Independence IA 50644-0388 Voice. Tax Credits.

Learn About Sales. Pay with a credit card in person and the fee generally is 230. This legislation from the year 2014 provides 100 exemption of property taxes for 100 disabled service-connected veterans and Dependency and Indemnity Compensation DIC recipients.

Forms are available by clicking on the Forms icon on the left side of this screen or wwwcedarcountyiowagov. Disabled Veteran Homestead Tax Credit. Or 3 owner was using as a homestead but did not previously file and 4.

PO Box 152 201 W Court Ave Winterset Iowa 50273. This could be a report card medical form sports enrollment paperwork or a piece of mail you have received. These credits will show on taxes payable in the fall of 2024.

Business Property Tax Credit. Adopted and Filed Rules. The address must be a physical address where you reside and not a post office box.

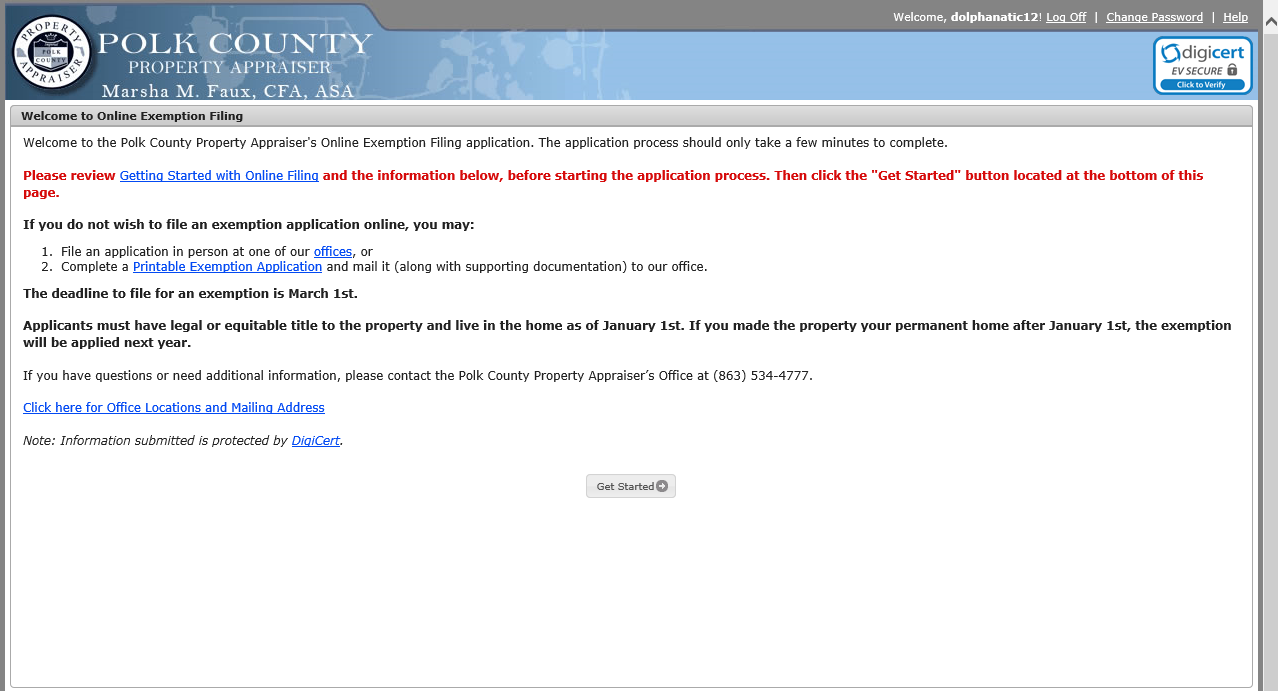

HF 2552 signed into law May 2022 has changed the requirements and no longer require businesses to submit an application to receive this credit. 2 has purchased a new or used home and is occupying the property as a homestead as of July 1st. The Homestead Tax Credit Application and Military Exemption Application can now be filled out online through the Vanguard website.

For further questions please contact our office at 563-927-2526 monday through Friday 800 am - 430 pm. Homestead Tax Credit. Learn About Property Tax.

IOWA RESIDENTS are eligible to file a claim for property tax credit if your 2021 total annual household income was less than 24354 and one of the following applies. Washington County Assessor 210 West Main Street McCreedy Building Washington Iowa 52353 Voice. Please call our office with any questions at 712-546-4705 or email epepperplymouthcountyiowagov.

Qualifying homeowners can get property tax credit up to 375 per year. NEW HOMEOWNERS-Be sure to apply for homestead and military Tax Credits by July 1. July 1 is the deadline for filing for the Homestead Credit and Military Exemption for 2023.

All three departments are open through the noon hour. Monday - Friday. Jefferson County Assessor 51 East Briggs Suite 6 Fairfield Iowa 52556 Voice.

Brandon Carpenter Assessor Beth Palmer AppraiserClerk. Buchanan County Assessor Buchanan County Courthouse PO. However if you will be conducting business with the Drivers License department during lunch time please call ahead to.

Learn More opens in a new tab Demo Videos opens in a new tab Register for Webinars opens in a new tab Like us on Facebook opens in a new tab. Application for Foster Care Donation Credit. We would like to show you a description here but the site wont allow us.

One time filing is provided by statute unless the property owner is 1 filing for Homestead Credit Military Exemption or Business Property Tax Credit for the first time. IOWA PROPERTY TAX CREDIT. Department of Iowa Revenue Apply.

800 am - 430 pm. Credit and debit card payments will incur a fee too but the fee depends on whether youre paying in person online or by phone. Pay with a debit card in person and there is a flat fee of 250.

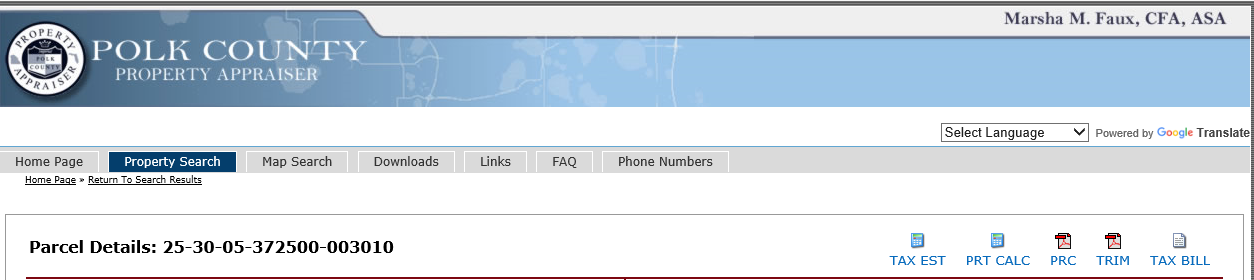

The credit will continue without further signing as long as it continues to qualify or until it is sold. Polk County Assessor 111 Court Ave. Additional credits for seniors 65 and older and the disabled.

65 years of age or older by December 31 2021. Claim forms are available at the Decatur County Treasurers Office. Economic Development for a Growing Economy Credit.

File a W-2 or 1099. Tax Levies and Assessed Values There are a number of different taxing districts in a jurisdiction each with a different levy. This credit is calculated by taking the levy rate times 4850 in taxable value.

2021 Tax Credit. Disabled Veterans Homestead Tax Credit. Tax Credits and Exemptions.

2021 Indiana Electronic Filing Opt-Out Declaration. - Room 195 Des Moines IA 50309. Homestead Tax Credit Sign up deadline.

Due to a 2022 legiislative change business property tax credit applications are NO LONGER required. The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa. Be sure to comply with state and local rules for claiming the tax exemption.

If an application is required submit your application for a homestead. Disabled Veteran Homestead Tax Credit. The following property tax credits andor exemption have an annual deadline of July 1st.

You must also bring one printed document showing your current name and current Iowa residential address. Le Mars Iowa 51031 Voice. Each year the County Auditor determines for that district a levy that will yield enough money to pay for schools police and fire protection road maintenance and other services budgeted for in that area.

Wayne County Assessor Wayne County Courthouse 100 N Lafayette St Suite 205 PO Box 435 Corydon IA 50060 Voice. Law. This office consists of three departments.

Ida County Courthouse 401 Moorehead Street Ida Grove IA 51445-1435 Voice. Feel free to contact the. Our office will mail a Homestead Tax Credit form to you after transfer paperwork is recorded and processed or you may find a pre-populated application within your parcel information on this website.

Filing An Exemption Application Online

Calls Mount To Link New Orleans Short Term Rentals To Homestead Exemption Local Politics Nola Com

Money Creation In A Fractional Reserve Banking System The Simplified Cartoon Version Money Creation Banking Monetary Policy

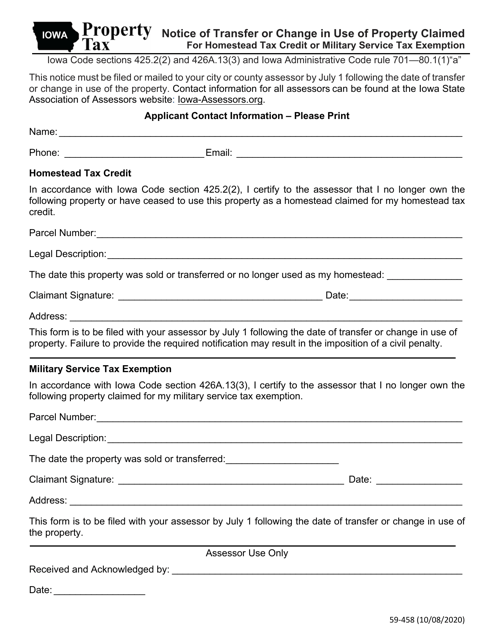

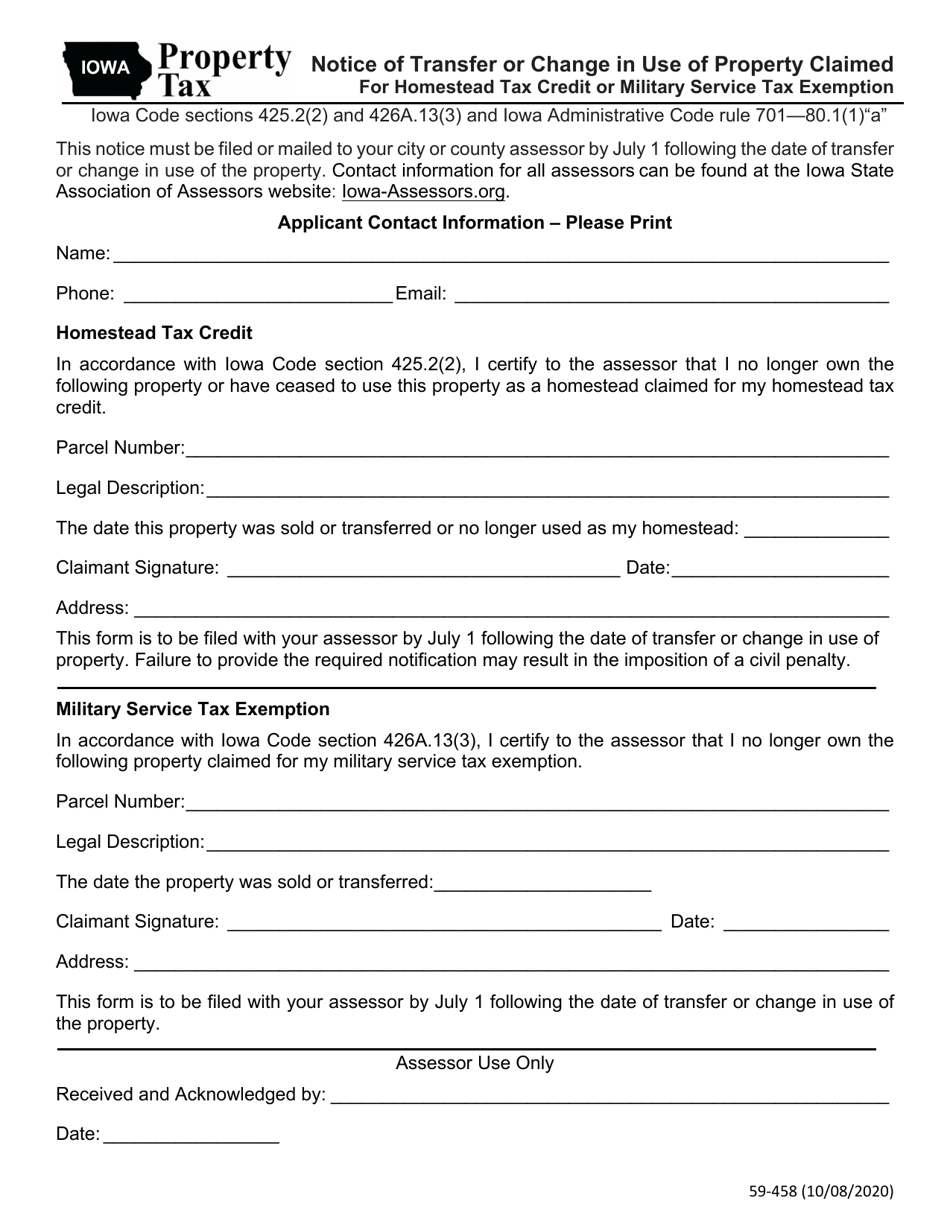

Form 59 458 Download Fillable Pdf Or Fill Online Notice Of Transfer Or Change In Use Of Property Claimed For Homestead Tax Credit Or Military Service Tax Exemption Iowa Templateroller

Your Guide To Property Tax In Minneapolis 2021

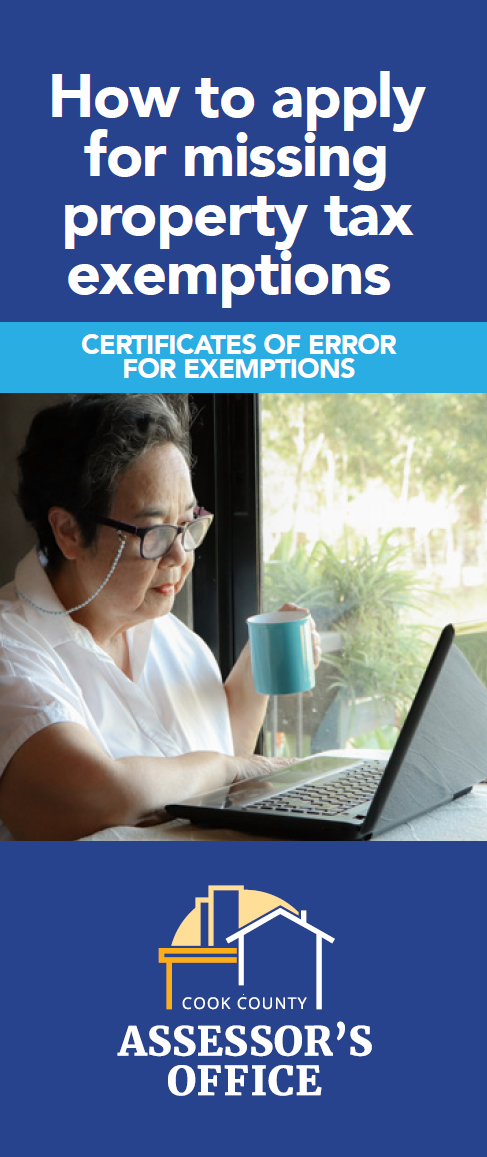

Longtime Homeowner Exemption Cook County Assessor S Office

Longtime Homeowner Exemption Cook County Assessor S Office

Calculating Property Taxes Iowa Tax And Tags

Those Crazy Iowa Property Taxes Home Sweet Des Moines

5 Homestead Ave Portland Me 04103 Mls 1536563 Coldwell Banker

Those Crazy Iowa Property Taxes Home Sweet Des Moines

Calculating Property Taxes Iowa Tax And Tags

Form 59 458 Download Fillable Pdf Or Fill Online Notice Of Transfer Or Change In Use Of Property Claimed For Homestead Tax Credit Or Military Service Tax Exemption Iowa Templateroller

Form 59 458 Download Fillable Pdf Or Fill Online Notice Of Transfer Or Change In Use Of Property Claimed For Homestead Tax Credit Or Military Service Tax Exemption Iowa Templateroller

Low Income Georgia Renters Could Receive Tax Credit Under New Proposal Georgia Thecentersquare Com